3 Simple Techniques For Feie Calculator

Table of Contents9 Simple Techniques For Feie CalculatorNot known Facts About Feie CalculatorThings about Feie CalculatorThe Greatest Guide To Feie CalculatorThe Buzz on Feie Calculator

United States deportees aren't restricted just to expat-specific tax obligation breaks. Typically, they can declare a lot of the very same tax obligation credit scores and deductions as they would in the US, including the Youngster Tax Obligation Credit Scores (CTC) and the Lifetime Learning Credit Report (LLC). It's feasible for the FEIE to decrease your AGI a lot that you do not get approved for specific tax obligation credit scores, however, so you'll need to verify your eligibility.

The tax code states that if you're an U.S. citizen or a resident alien of the USA and you live abroad, the IRS taxes your globally income. You make it, they tire it despite where you make it. You do get a nice exclusion for tax obligation year 2024 - Foreign Earned Income Exclusion.

For 2024, the optimal exclusion has actually been raised to $126,500. There is likewise a quantity of qualified real estate expenditures eligible for exclusion.

Some Known Details About Feie Calculator

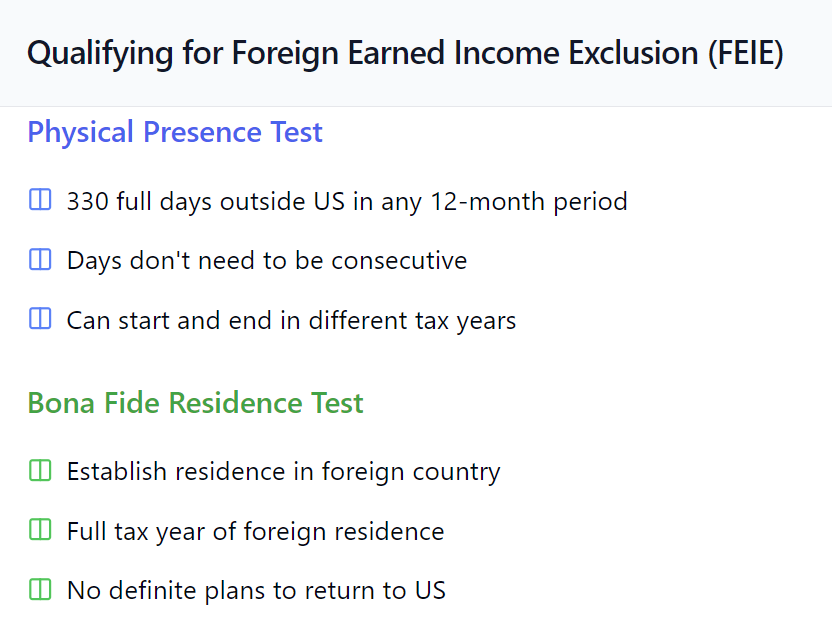

You'll have to figure the exemption first, because it's limited to your foreign made income minus any kind of foreign real estate exemption you claim. To get the foreign gained earnings exclusion, the international real estate exemption or the foreign real estate deduction, your tax home must remain in a foreign country, and you have to be just one of the following: A bona fide local of a foreign country for a nonstop duration that includes a whole tax obligation year (Authentic Homeowner Examination).

for a minimum of 330 complete days during any period of 12 successive months (Physical Presence Examination). The Authentic Local Test is not relevant to nonresident aliens. If you declare to the international government that you are not a citizen, the examination is not pleased. Eligibility for the exclusion can likewise be affected by some tax obligation treaties.

For U.S. residents living abroad or gaining earnings from international sources, concerns often arise on just how the united state tax obligation system puts on them and exactly how they can ensure compliance while minimizing tax obligation responsibility. From comprehending what foreign revenue is to browsing different tax return and deductions, it is essential for accountants to comprehend the ins and outs of U.S.

Jump to Foreign income is defined as any income made from sources beyond the United States. It includes a large range of economic activities, including but not restricted to: Incomes and incomes made while working abroad Bonus offers, allowances, over here and benefits offered by foreign employers Self-employment revenue stemmed from foreign organizations Passion made from foreign savings account or bonds Rewards from foreign firms Funding gains from the sale of foreign assets, such as property or supplies Revenues from renting international homes Earnings produced by foreign services or partnerships in which you have a passion Any other revenue earned from foreign sources, such as aristocracies, alimony, or wagering earnings Foreign earned income is defined as revenue earned via labor or solutions while living and operating in an international nation.

It's important to identify foreign made earnings from various other kinds of international revenue, as the Foreign Earned Revenue Exemption (FEIE), a valuable U.S. tax obligation advantage, specifically relates to this group. Investment income, rental income, and easy income from foreign sources do not get approved for the FEIE - Form 2555. These types of income might be subject to various tax obligation treatment

resident alien who is that citizen or resident of a country with which the United States has an income tax treaty in effect and result is that bona fide resident of local foreign country or nation for an uninterrupted period undisturbed duration an entire tax yearTax obligation or A U.S. citizen united state person U.S.

Foreign earned income. You must have a tax obligation home in a foreign nation.

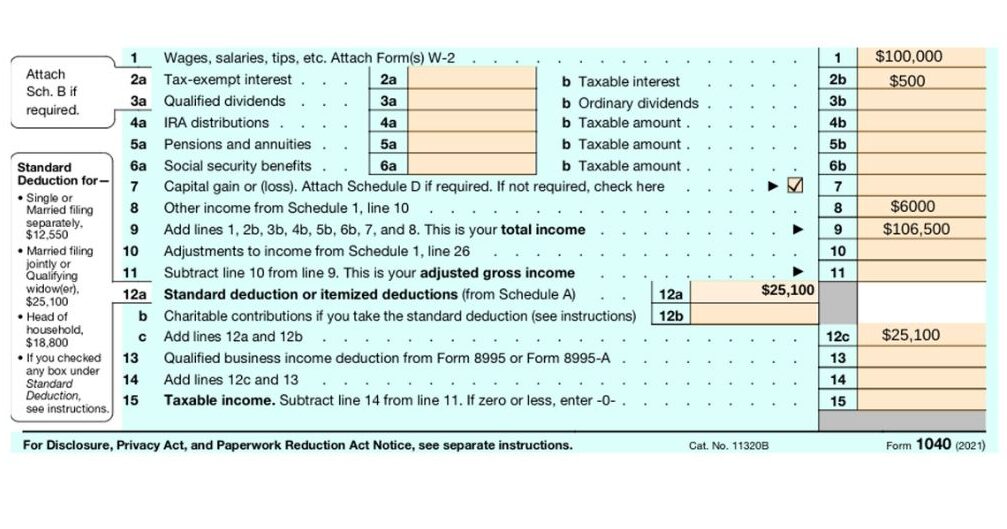

This credit rating can offset your United state tax obligation obligation on international earnings that is not qualified for the FEIE, such as investment revenue or passive earnings. If you do, you'll after that file added tax obligation kinds (Type 2555 for the FEIE and Form 1116 for the FTC) and affix them to Type 1040.

Things about Feie Calculator

The Foreign Earned Income Exclusion (FEIE) allows eligible people to omit a part of their international made income from united state taxation. This exemption can considerably lower or eliminate the united state tax obligation on foreign income. Nevertheless, the specific quantity of international income that is tax-free in the united state under the FEIE can transform yearly due to inflation changes.